NOVA

The tokenomics of Supernova is designed with this mandate in mind:

To make the protocol better by incentivizing good behaviors and penalizing bad behaviors.

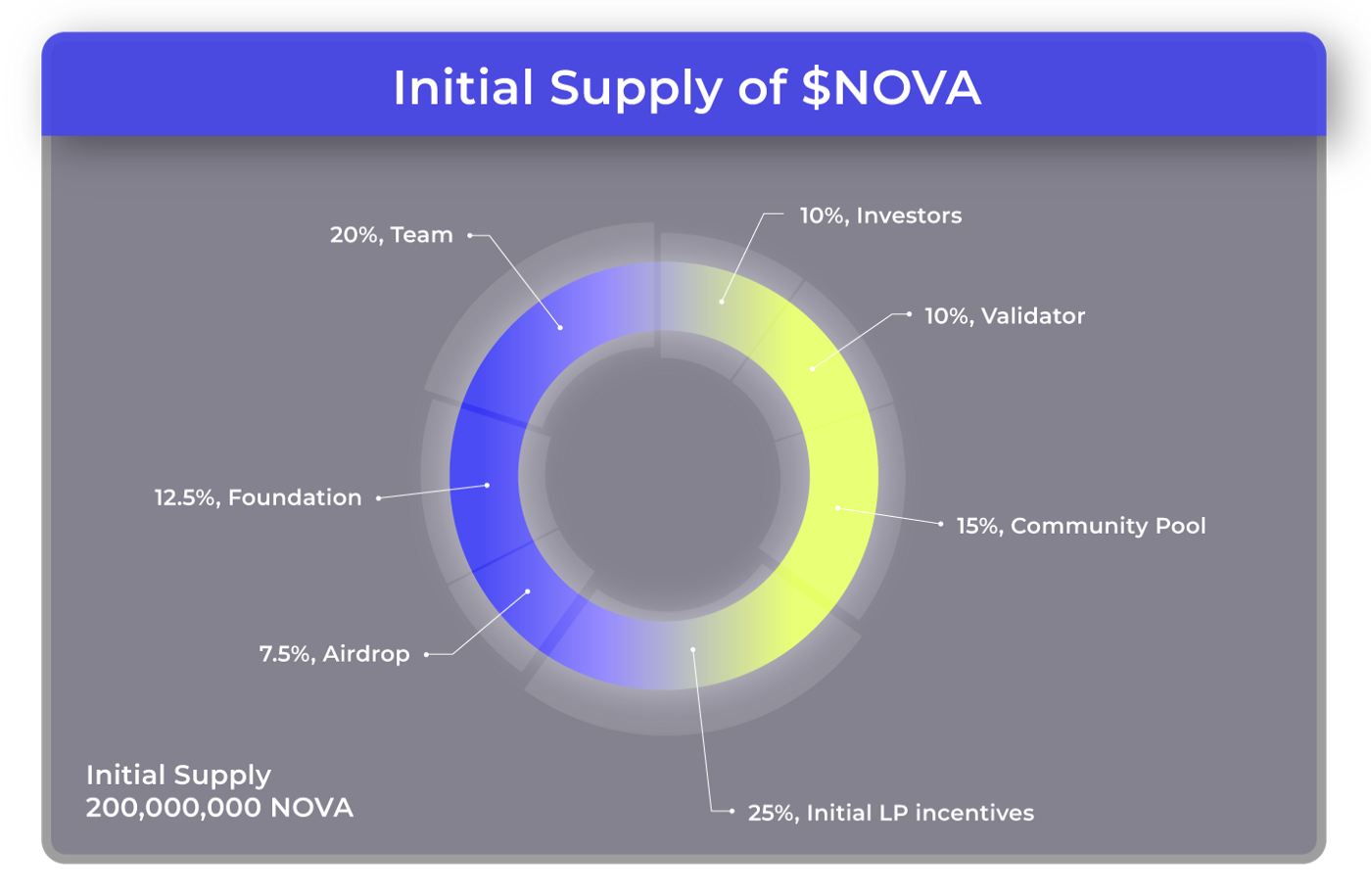

Genesis Distribution

Supernova’s governance token is called $NOVA.

The planned amount of tokens to be minted at the genesis is 200,000,000 NOVA.

While it is the intended amount to be minted, the actual amount that will be circulated will be less due to the vesting period, etc. (i.e. the initial allocation for the community pool and foundation will likely not be used for some time to come.)

Investors

10% (20,000,000 NOVA)

Allocated to those who are interested in liquid staking or have exposure to the Cosmos ecosystem. Vested over two years with a one-year cliff.

Validator delegation program

10% (20,000,000 NOVA)

Allocated for validators who will serve as validtors of Supernova chain. Currently plans to delegate 200,000 NOVA to 100 validators, but the amount is subject to change depending on the value they add to Supernova.

Initial incentives

25% (50,000,000 NOVA)

Allocated to incentivize users of Supernova. At genesis, it will be allocated to incentivize liquidity providers at staked swap pool. Also to be allocated to the Osmosis incentive program to $NOVA pool.

Community pool

15% (30,000,000 NOVA)

Works as a strategic reserve. Its future use will be determined via governance.

Airdrop

7.5% (15,000,000 NOVA)

Allocated for the delegators (ATOM stakers) who support making Supernova validator active. Supernova deploys a single validator on the target app-chain. To make it active, we decided to airdrop some amount of NOVA. More details will be shared in an airdrop announcement.

Foundation

12.5% (25,000,000 NOVA)

Allocated to reward contributions to the Supernova’s ecosystem. i.e. relayer grant, hackathon or hackerhouse, translation, etc. Will ‘only’ be distributed via governance.

Team

20% (40,000,000 NOVA)

Allocated to incentivize the current and future members of the Supernova team. Vested over 2.5 years with a 1.5-year cliff.

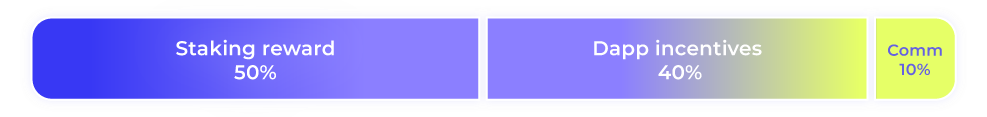

Token Distribution

Newly minted tokens will be allocated as follows:

- 50% to the Staking rewards to reward validators and delegators.

- 40% to the Dapp incentive pools for ongoing incentives to users. During Gamma-1, it would go to liquidity providers.

- 10% to the community pool controlled by governance.

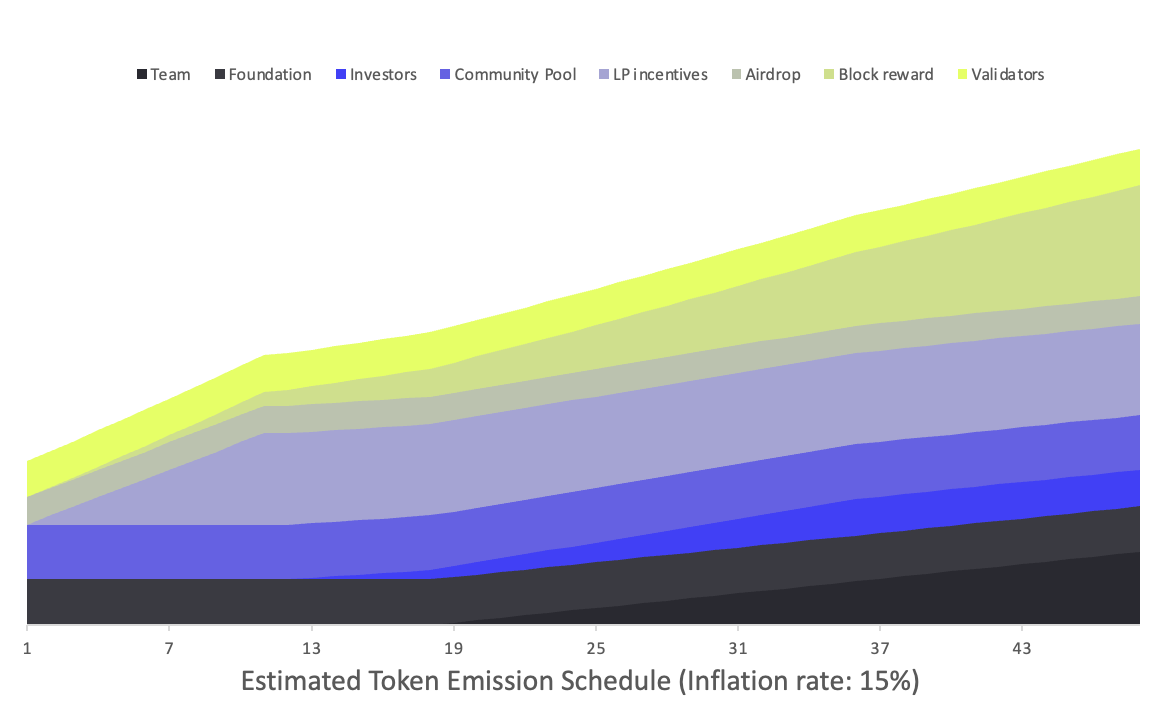

Estimated Token Emission

Since Supernova has the dynamic inflation rate, it should be estimated through assumptions rather than expecting to get an exact number. The table above was created estimating the inflation rate at 15% and shows changes by month.

You can also play with the simulator that we made in our GitHub.

Inflation Rate

In short, NOVA inflation rate is as same as ATOM (v1.0).

- It is adjustable depending on the staking rate.

- It is limited to a minimum of 7% and a maximum of 20%.

- The inflation rate cannot increase or decrease faster than 13% per year.

- The speed of the inflation rate depends upon the target bonded ratio and the inflation rate change.